How to recover unpaid invoices legally: Step-by-step guide for SMEs

You’ve done the work, sent the invoice, and kept things polite. Now the deadline’s passed, and your inbox is quiet. Every day that payment drags on, your cash flow tightens and your frustration grows. The truth is, you don’t have to chase endlessly or risk relationships to get paid. UK law gives you clear rights and a simple, professional way to recover overdue invoices, and to make sure it doesn’t happen again.

Why unpaid invoices are a serious risk for small businesses

Cash flow keeps every business moving. When payments are delayed, operations stall, plans are postponed, and growth slows. Across the UK, small businesses tell us that overdue invoices are one of the most common causes of financial strain, tying up valuable cash and hours in follow-up emails and phone calls.

With all our clients, we see the same pattern: the issue isn’t only financial, it’s emotional. Late payments create short-term pressure but also strain trust, relationships, and energy. Over time, the effort of chasing money quietly outweighs the value of the work itself.

That’s where the law provides support. Understanding your legal rights and having a clear, structured process to recover overdue invoices helps you stay in control, protect your cash flow, and maintain your professionalism. When you approach recovery the right way, it becomes part of good business practice rather than a source of stress.

Your legal rights under UK law

Under the Late Payment of Commercial Debts (Interest) Act 1998, UK businesses supplying goods or services to other companies can claim compensation when invoices are paid late. You are entitled to:

1. Statutory interest at 8% above the Bank of England base rate

2. A fixed recovery fee:

- £40 for debts under £1,000

- £70 for debts between £1,000 and £10,000

- £100 for debts over £10,000

If your contract already includes fair late-payment terms, those will apply instead.

Where no payment date is agreed, payment is treated as late 30 days after the buyer receives the goods or the invoice, whichever is later.

These rights apply automatically across business-to-business transactions, giving every UK company a consistent legal foundation for late payment claims.

Legal insight: When your right to payment takes effect

The Act automatically implies a term into every business-to-business contract, giving you the right to claim interest, a fixed recovery fee, and reasonable costs of recovering the debt as soon as a valid invoice becomes overdue. The protection applies even where the contract isn’t in writing, as long as the work was done in the course of business.

Courts have reinforced this protection in practice. In Christopher Linnett Ltd v Harding (t/a Harding Contractors) [2017] EWHC 1781 (TCC), the High Court confirmed that the Act applied between two sole traders because both were operating as businesses. More recently, in Pharos Offshore Group Ltd v Keynvor Morlift Ltd [2025] EWHC 2496 (TCC), the court held that statutory interest under the Act includes VAT when the contract requires it to be paid. These cases confirm that UK courts consistently uphold creditors’ rights under the Act.

In simple terms, once the payment deadline passes, your right to interest and compensation arises automatically. You don’t need to give prior notice or include these terms in your contract; the law does that for you.

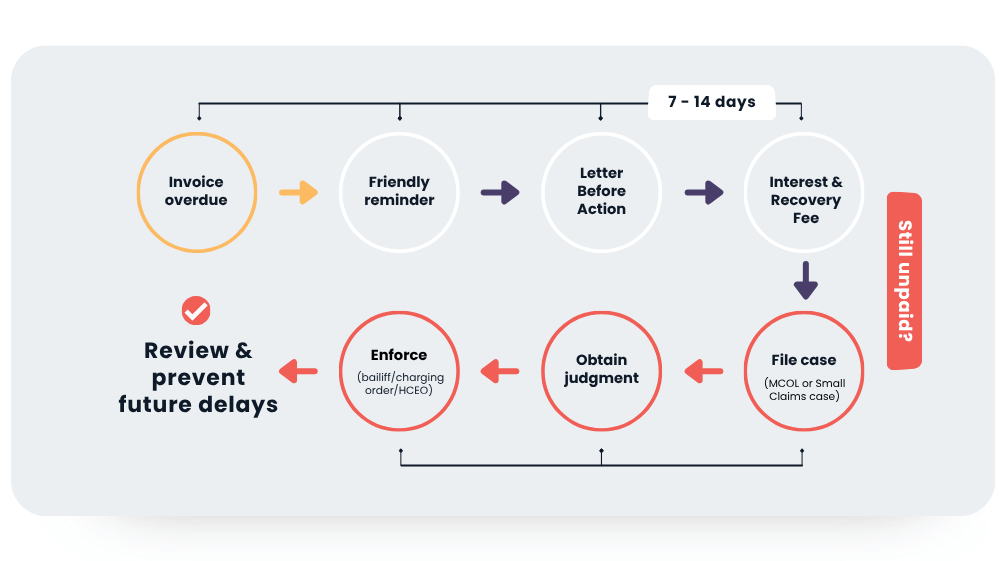

A calm, step-by-step recovery process

1. Check your records

We always advise our clients to start with the basics. Check that the invoice is accurate, addressed to the correct entity, and supported by proof of delivery or completion. If the client has raised a genuine dispute, address it before pursuing payment further. In debt matters, accuracy and documentation carry real weight. When it comes to debt recovery, the details often make the difference between payment and delay.

2. Send a polite reminder

A short, friendly message is often all it takes. Reference the invoice number, amount, and due date. Keep the tone factual and professional. In our experience, many clients respond once prompted.

3. Send a formal letter before action

If payment still hasn’t arrived after a week or two, it’s time to send a Letter Before Action (LBA). This formal notice sets out precisely what is owed, refers to your right to claim interest and recovery costs, and gives the client a final deadline to pay, usually between seven and fourteen days.

Under the Pre-Action Protocol for Debt Claims, this step is a legal requirement before issuing court proceedings. It shows that you’re acting professionally and giving the other party a fair opportunity to resolve the matter.

At Lawyerlink, we often advise clients not to use this letter in a confrontational way, but rather to ensure clarity. It signals that you value fair business practice and are following the proper process to protect your position. In many cases, a well-drafted Letter Before Action prompts payment without the need for any further legal steps.

4. Add interest and recovery costs

Once the deadline passes, add your lawful interest and recovery fee. For example, a £2,000 invoice that’s 60 days overdue could include roughly £26 in interest plus £70 in compensation.

5. Consider legal escalation

If the invoice remains unpaid, you can take formal action.

- Money Claim Online (MCOL) is the simplest route for straightforward debts up to £100,000.

- The Small Claims track handles most claims of £10,000 or less.

- A statutory demand can be used for undisputed debts of £750 or more.

Before escalating, weigh the cost, time, and likelihood of recovery.

For procedural guidance, see the Small Business Commissioner’s advice.

6. Enforce the judgment

Getting a court order is an important milestone, but it doesn’t always guarantee immediate payment. In our experience, this stage often calls for persistence and the right strategy. If payment hasn’t been made yet, several effective enforcement options are available. Depending on the debtor’s assets, you may instruct County Court bailiffs or High Court enforcement officers, or apply for a charging order or third-party debt order. The key is to stay methodical, seek sound legal advice, and choose the route that delivers the best balance between cost, time, and recovery potential.

7. Review and prevent future delays

Once a payment issue is resolved, take time to look at what caused it. Were your payment terms clear and visible on every contract and invoice? Could shorter credit periods, staged deposits, or upfront retainers reduce the risk?

With many of our clients, we find that a proactive approach transforms cash flow over time. Automating invoice reminders, monitoring overdue accounts weekly, and establishing consistent follow-up routines prevent late payments from becoming the norm. Reviewing your systems regularly means you’re not just reacting to debt — you’re actively building a culture where your business gets paid on time.

At a glance: debt recovery flow

Caption: A practical visual guide to recovering unpaid invoices legally and calmly.

Common questions

Can I always charge interest?

Yes, if it’s a business-to-business transaction. Mention it clearly on your invoice to remind clients of their legal obligation.

What if the client disputes the invoice?

Pause recovery and address the issue first. Courts expect both sides to act reasonably before formal action.

How long do I have to act?

You usually have six years (five in Scotland) from the due date under the Limitation Act 1980.

Will I recover legal fees?

You can usually recover court fees, and in larger claims, some legal costs may also be awarded.

Is it worth pursuing smaller debts?

Often yes. Consistent follow-up sets a precedent that encourages timely payment from all clients.

Preventing late payment next time

Recovery is important, but prevention is better. Strong contracts and systems can dramatically reduce risk. Consider:

- Clear written payment terms on every invoice and contract.

- Deposits or staged payments for new or high-value clients.

- Credit checks before onboarding.

- Automated invoice reminders.

- Monthly reviews of outstanding accounts.

A consistent process protects your business and signals professionalism and reliability.

Work with our legal team for help

Chasing payments takes energy away from running your business. At Lawyerlink, our solicitors and lawyers help SMEs recover overdue invoices efficiently and strengthen payment terms to prevent future issues.

Our subscription plans include debt recovery support, contract reviews, employment advice, and compliance guidance, all at a transparent monthly cost.

.png?width=500&name=The%20DIY%20legal%20temptation%20_%20Lawyerlink%20UK%20(1).png)